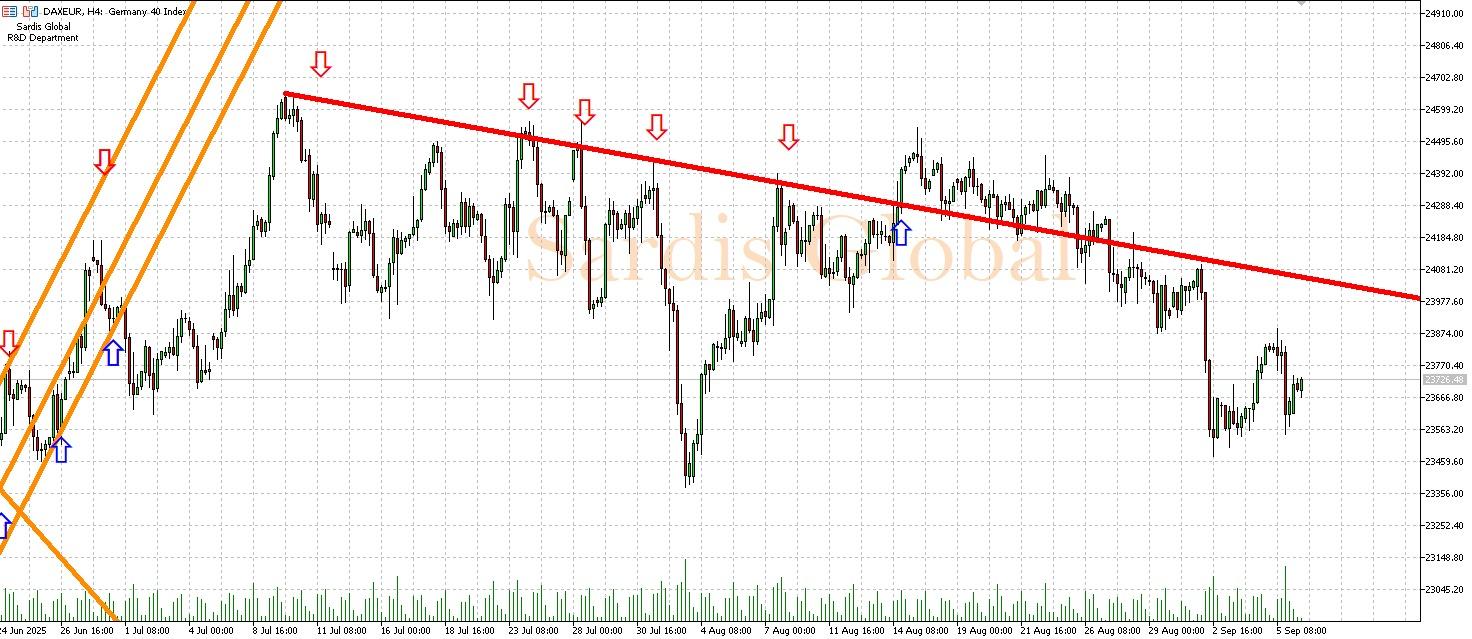

DAXEUR

Europe's leading index DAX is just below the pivot level of 23686.30 points, waiting for a heavy flow of data that will determine global risk appetite. There are two main focal points for the index this week: the ECB interest rate decision and press conference on Thursday, along with US inflation data throughout the week. If the ECB keeps interest rates steady and President Lagarde delivers dovish (loose monetary policy-friendly) messages during the press conference, it would be the most favorable scenario for the index. Additionally, if US inflation data aligns with expectations, it would increase global risk appetite. In this positive environment, it is likely that the DAX will break the resistance at 23825.79 and rally towards 24030.38. However, unexpected hawkish statements from the ECB and persistently high US inflation keeping interest rate hike concerns alive could trigger a wave of selling in the indices. In this case, the support level at 23481.71 would be the first stop, while if the selling deepens, the level of 23342.21 could be tested.