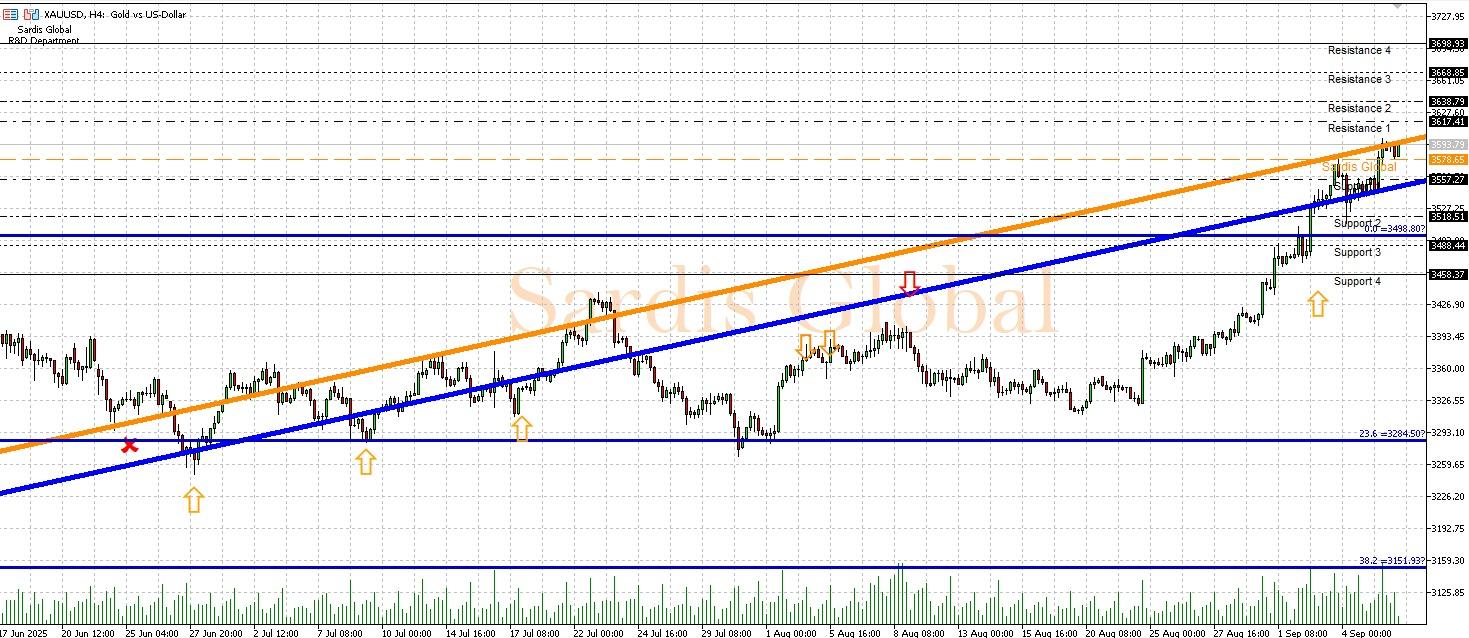

XAUUSD

Gold is holding above the pivot level of $3578.65 as it enters the new week, awaiting dovish signals from U.S. inflation data. For gold investors, the most critical days of the week will be Wednesday (PPI) and Thursday (CPI). If a slowdown in U.S. inflation or below-expectation figures are observed, it will strengthen the perception that the Fed has reached the end of its rate hike cycle, weakening the dollar and increasing demand for gold, a non-yielding asset. In this positive scenario, the price is expected to quickly target the resistance at $3617.41. Breaking through this barrier could carry the rise to the levels of $3638.79 and then $3668.85. Conversely, if inflation proves stubborn and exceeds expectations, it could trigger a rally in the dollar, creating strong selling pressure on gold. In this case, a pullback to the support at $3557.27 could be likely, and if broken, a retreat to the main support at $3518.51 may be inevitable.