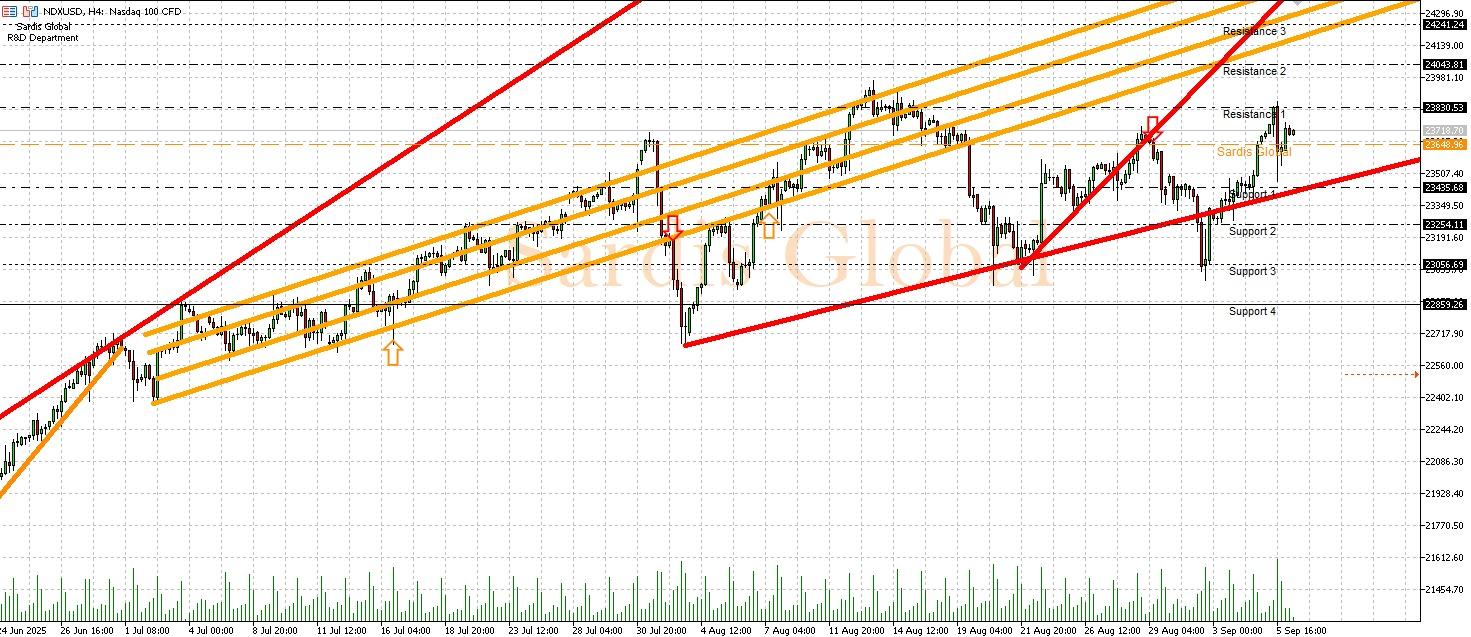

NDXUSD

The Nasdaq 100, which is sensitive to interest rates, started the week positively just above the pivot of 23648.96, hoping to see a slowdown in inflation data from the US. The fate of technology stocks this week depends on the PPI on Wednesday and the CPI on Thursday. A cooling in inflation would ease the FED's hand and strengthen expectations that interest rate hikes have come to an end, increasing interest in technology stocks. In this "risk-on" scenario, the index is expected to target the resistance at 23830.53, and if it rises above this level, it will likely continue to climb towards 24043.81 and 24241.24. Conversely, if inflation remains hot and sticky, it would reignite concerns over interest rate hikes, leading to a sharp sell-off in technology stocks. In this case, it would not be surprising for the index to quickly pull back to the support level of 23435.68 and, if broken, down to 23254.11.