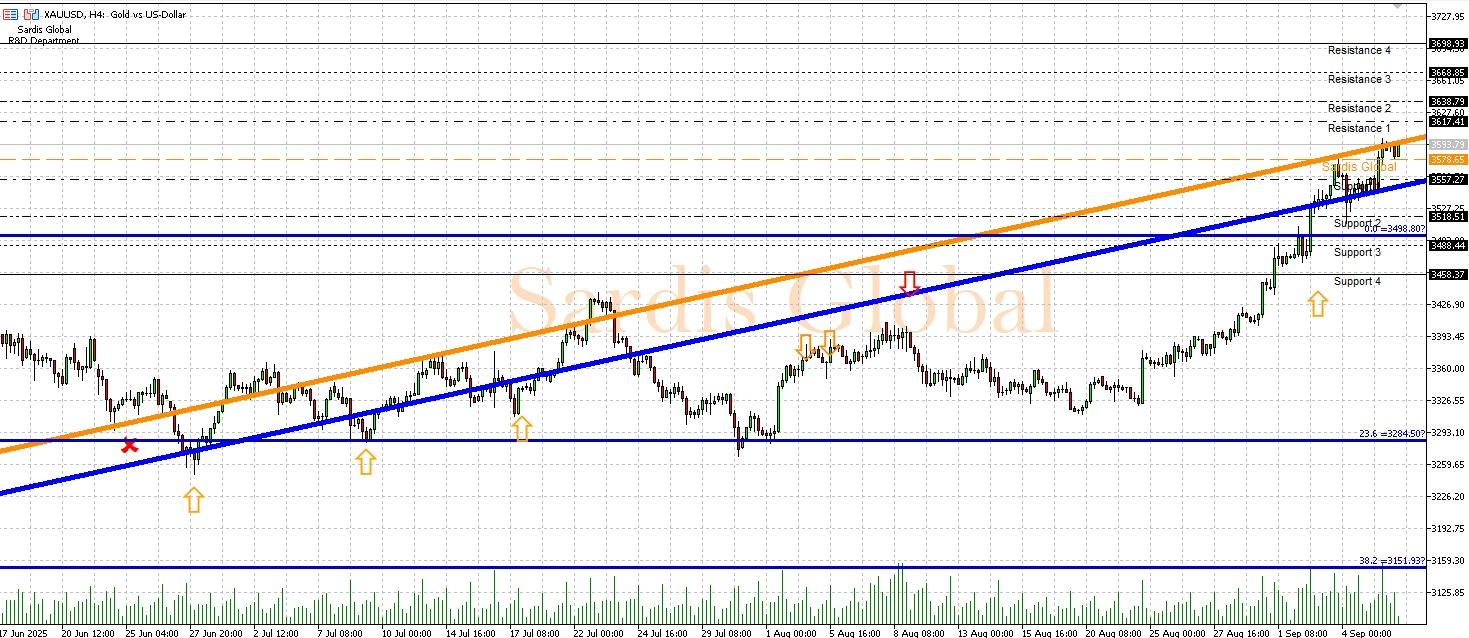

XAUUSD

Gold is starting the new week by holding above the pivot level of $3578.65, awaiting dovish signals from upcoming US inflation data. For gold investors, the most critical days this week will be Wednesday (PPI) and Thursday (CPI). A slowdown in US inflation or figures coming in below expectations, as the markets anticipate, would strengthen the perception that the Fed has reached the end of its interest rate hike cycle, weakening the Dollar and increasing demand for Gold, which is a non-yielding asset. In this positive scenario, the price is expected to quickly target the resistance at $3617.41. Breaking through this barrier could push the rally to levels of $3638.79 and then $3668.85. Conversely, stubborn inflation that exceeds expectations could trigger a rally in the Dollar, creating strong selling pressure on Gold. In this case, a pullback to the support at $3557.27 would be likely, and if broken, a further decline to the main support at $3518.51 could be unavoidable.