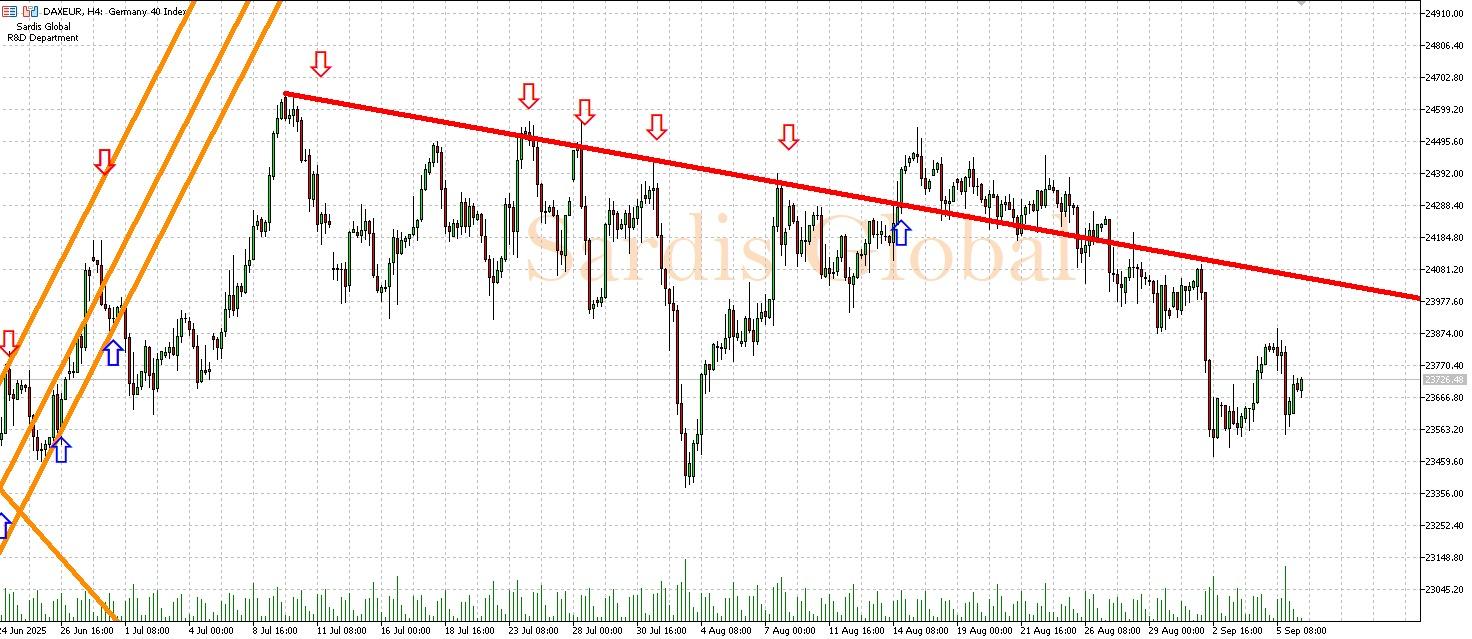

DAXEUR

Europe's leading index DAX is just below the pivot level of 23686.30 points, awaiting a heavy flow of data that will determine global risk appetite. There are two main focal points for the index this week: the ECB's interest rate decision and press conference on Thursday, along with US inflation data throughout the week. If the ECB keeps interest rates steady and President Lagarde delivers dovish (accommodative monetary policy-friendly) messages in the press conference, it would be the most favorable scenario for the index. Additionally, if US inflation data aligns with expectations, it would boost global risk appetite. In this positive environment, it is likely that the DAX will break the resistance at 23825.79 and rally towards 24030.38. However, any unexpected hawkish statements from the ECB and US inflation remaining high, keeping concerns over interest rate hikes alive, could trigger a wave of selling in the indices. In this case, the support level at 23481.71 would be the first stop, while if selling deepens, the level of 23342.21 could be tested.