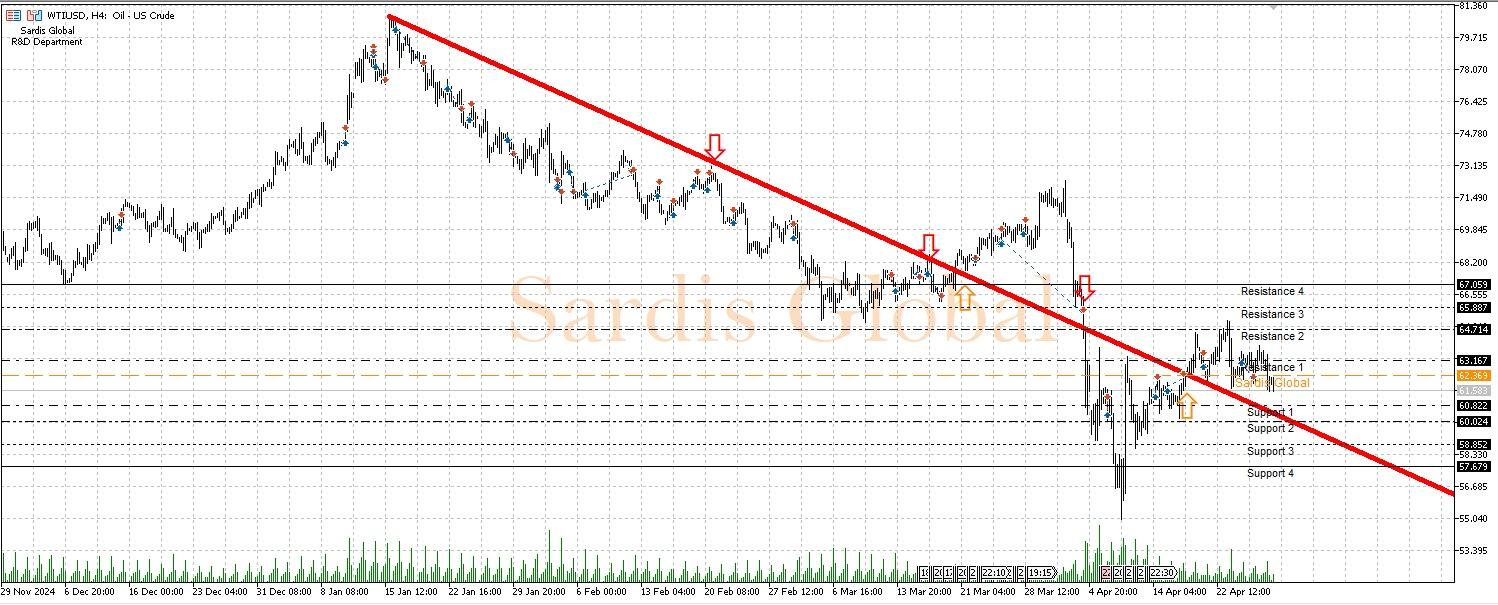

WTIUSD

WTI is being supported by signals from the OPEC+ group to continue production cuts even after June. It is expected that OPEC+ will extend the current cuts of 2.2 million barrels per day during the Vienna meeting on June 1st into the third quarter. While the decrease in U.S. commercial crude oil stocks and the increase in refinery capacities have a positive effect, weak economic data from China is raising concerns about global demand; however, expectations that China will expand its economic stimulus package are a positive factor. Technically, WTI is trading sideways around $61.50, and if the resistance at $62.36 is broken, it could rise towards $63.16, while in a downward movement, $60.82 will be watched as the first support.

Support :

Resistance :