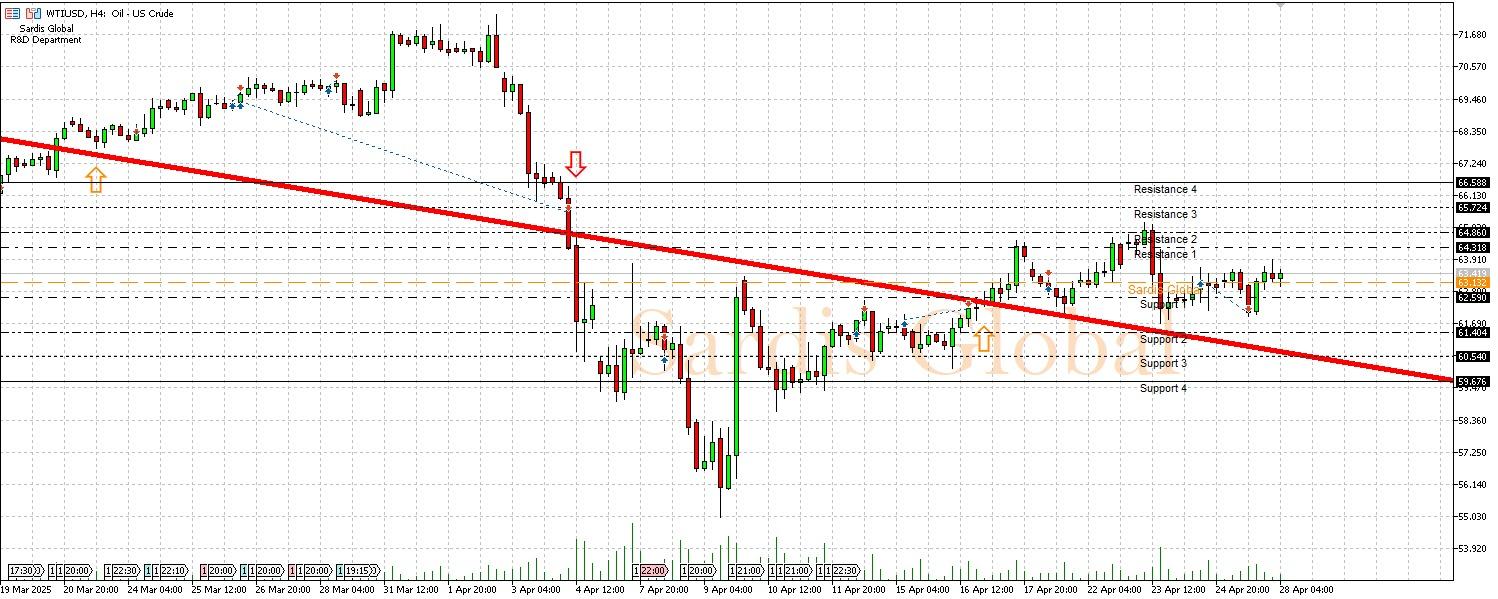

WTIUSD

The critical day for oil prices will be Wednesday. US crude oil stock data will be decisive in price movements. An increase in stocks reported by the Energy Information Administration (EIA) could increase pressure on WTI. The Manufacturing PMI data, which signals China's economic activity, is expected to move into the contraction zone, which could raise concerns about global demand. On the other hand, signs of a slowdown in the US economy and developments in the Middle East will also be closely monitored. If the 63.13 pivot level is exceeded, a movement towards the 64.31 resistance could begin. However, if the 64.31 resistance is broken, resistance levels may be monitored for selling pressure.

Support :

Resistance :