GBPUSD

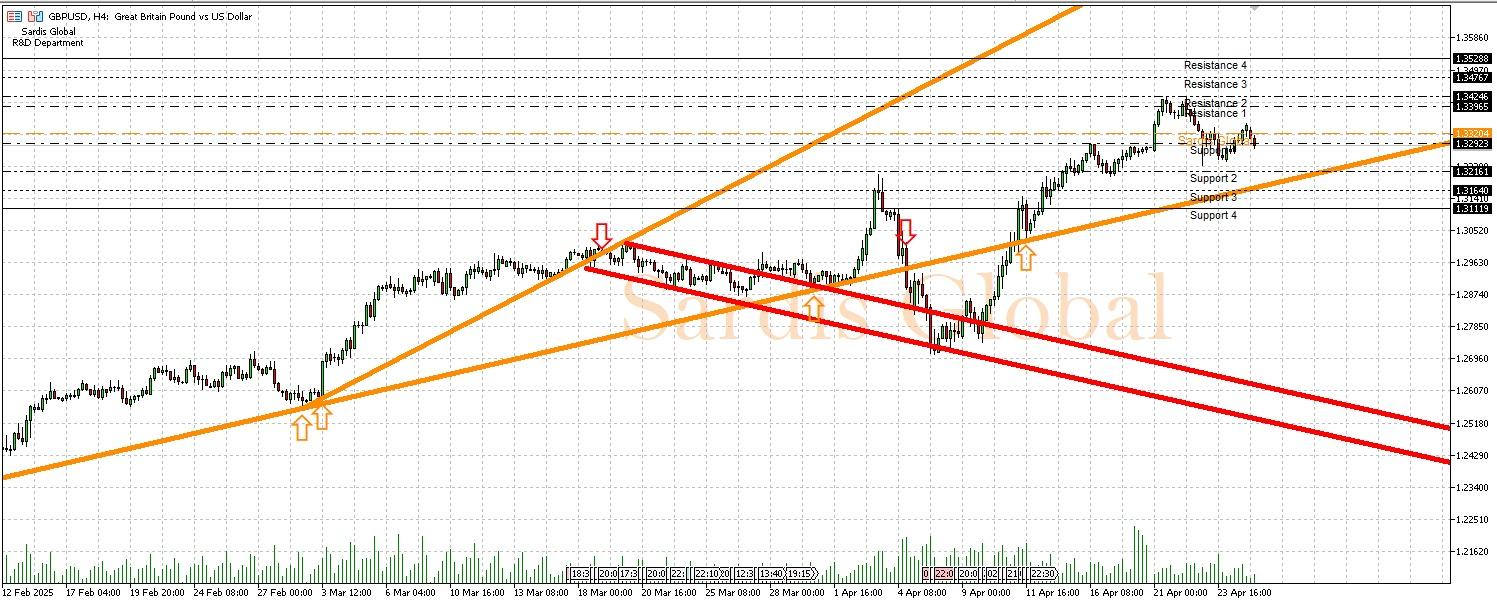

The lower-than-expected March inflation and weak PMI data (48.2) announced in the UK are paving the way for a possible interest rate cut by the BoE on May 8. Despite this, the pair is trading at 1.33293, marking its longest rise of the year. The unemployment claims announced in the US yesterday came in at 222K, aligning with expectations and leading to a partial strengthening of the dollar. Holding above the 1.3320 pivot level for the pair may support a move towards the 1.3395 resistance. However, if the 1.3292 support is broken, the decline could accelerate down to the 1.3216 level.

Support :

Resistance :